As the accounting industry continues to evolve, accounting firms are under increasing pressure to stay ahead of the curve. Technology plays a vital role in this, enabling firms to streamline processes, improve accuracy, and provide better services to clients. In this article, we will explore the top 10 essential tools that should be included in an accounting firm's tech stack.

What is a Tech Stack?

A tech stack refers to the collection of software, hardware, and other digital tools used by a business or organization to operate and deliver its services. For accounting firms, a well-designed tech stack is crucial for maximizing efficiency, reducing costs, and improving client satisfaction.

Benefits of a Well-Designed Tech Stack

A well-designed tech stack can bring numerous benefits to an accounting firm, including:

- Improved efficiency and productivity

- Enhanced accuracy and reduced errors

- Better client satisfaction and engagement

- Increased security and compliance

- Cost savings and improved profitability

Top 10 Essential Tools for an Accounting Firm's Tech Stack

-

Cloud Accounting Software

Cloud accounting software is a must-have for any accounting firm. It provides a secure, scalable, and accessible platform for managing financial data, invoicing, and bookkeeping. Popular options include QuickBooks, Xero, and Sage.

-

Client Portal Software

Client portal software enables firms to securely share financial documents and communicate with clients online. This improves client engagement, reduces paperwork, and enhances the overall client experience. Examples include ShareFile, SmartVault, and ClientSafe.

-

Practice Management Software

Practice management software helps firms streamline workflow, manage projects, and track time and expenses. This improves productivity, reduces administrative burdens, and enables better decision-making. Popular options include CCH Axcess, Thomson Reuters CS Professional Suite, and Practice Engine.

-

Tax Preparation Software

Tax preparation software is essential for firms that provide tax services. It enables the efficient preparation and filing of tax returns, reducing errors and improving compliance. Examples include TurboTax, TaxAct, and Lacerte.

-

Audit and Assurance Software

Audit and assurance software helps firms perform audits, reviews, and compilations more efficiently and effectively. It provides tools for risk assessment, audit planning, and testing, as well as reporting and documentation. Popular options include AuditBoard, Wolters Kluwer CCH ProSystem fx, and CaseWare.

-

Financial Planning and Analysis Software

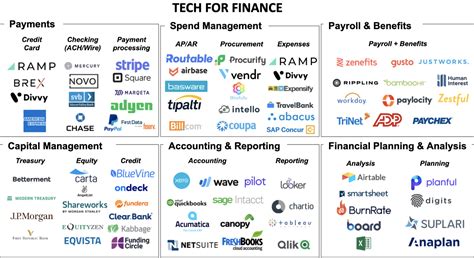

Financial planning and analysis software enables firms to provide clients with comprehensive financial planning and analysis services. It provides tools for budgeting, forecasting, and financial modeling, as well as performance reporting and benchmarking. Examples include Adaptive Insights, Anaplan, and IBM Planning Analytics.

-

Compliance and Risk Management Software

Compliance and risk management software helps firms manage regulatory compliance, identify and mitigate risks, and implement effective controls. Popular options include Thomson Reuters Accelus, Wolters Kluwer CCH Compliance Management, and LogicManager.

-

Document Management Software

Document management software enables firms to securely store, manage, and retrieve financial documents and other critical files. This improves organization, reduces paper clutter, and enhances collaboration. Examples include SharePoint, Documentum, and NetDocuments.

-

Time and Billing Software

Time and billing software helps firms track time and expenses, create invoices, and manage accounts receivable. This improves cash flow, reduces administrative burdens, and enhances profitability. Popular options include TSheets, Harvest, and BillQuick.

-

Cybersecurity Software

Cybersecurity software is essential for protecting firm data and client information from cyber threats. It provides tools for threat detection, prevention, and response, as well as security awareness training and compliance management. Examples include Norton Antivirus, McAfee Endpoint Security, and Cyberark.

Implementing a Tech Stack in Your Accounting Firm

Implementing a tech stack in your accounting firm can seem daunting, but with a clear plan and vision, it can be a smooth and successful process. Here are some steps to follow:

-

Assess Your Current Tech Environment

Assess your firm's current tech environment, including software, hardware, and other digital tools. Identify areas for improvement and opportunities for innovation.

-

Define Your Tech Strategy

Define your firm's tech strategy, including goals, objectives, and key performance indicators (KPIs). Identify the tools and technologies needed to achieve your strategy.

-

Select and Implement Tools

Select and implement the tools and technologies identified in your tech strategy. Ensure they are scalable, secure, and user-friendly.

-

Train and Support Staff

Train and support staff on the new tools and technologies. Provide ongoing training and support to ensure successful adoption and utilization.

-

Monitor and Evaluate

Monitor and evaluate the effectiveness of your tech stack. Identify areas for improvement and make adjustments as needed.

Conclusion

In conclusion, a well-designed tech stack is essential for accounting firms to remain competitive, efficient, and effective. By selecting and implementing the right tools and technologies, firms can improve client satisfaction, reduce costs, and enhance profitability. Remember to assess your current tech environment, define your tech strategy, select and implement tools, train and support staff, and monitor and evaluate the effectiveness of your tech stack.

What is a tech stack?

+A tech stack refers to the collection of software, hardware, and other digital tools used by a business or organization to operate and deliver its services.

What are the benefits of a well-designed tech stack?

+A well-designed tech stack can bring numerous benefits, including improved efficiency and productivity, enhanced accuracy and reduced errors, better client satisfaction and engagement, increased security and compliance, and cost savings and improved profitability.

What are the top 10 essential tools for an accounting firm's tech stack?

+The top 10 essential tools for an accounting firm's tech stack include cloud accounting software, client portal software, practice management software, tax preparation software, audit and assurance software, financial planning and analysis software, compliance and risk management software, document management software, time and billing software, and cybersecurity software.