In today's fast-paced and rapidly evolving business landscape, the role of the Chief Financial Officer (CFO) has undergone a significant transformation. No longer just a number-cruncher, the modern CFO is expected to be a strategic leader, driving growth, and making data-driven decisions to propel the organization forward. To stay ahead of the curve, CFOs need to leverage technology to streamline financial operations, enhance decision-making, and foster collaboration across the organization.

A well-designed CFO tech stack is critical to achieving these goals. In this article, we'll delve into the essential components of a modern CFO tech stack, explore the benefits of each tool, and provide guidance on how to implement them effectively.

What is a CFO Tech Stack?

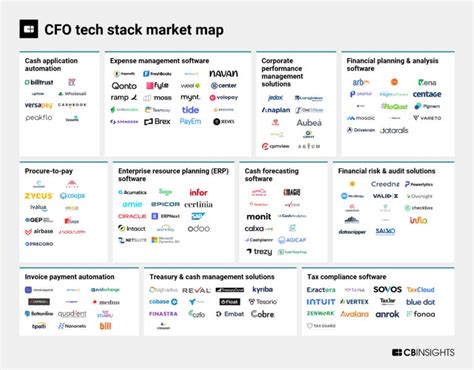

A CFO tech stack refers to the collection of software applications, tools, and platforms used by the finance function to manage financial operations, analyze data, and make informed decisions. A modern CFO tech stack typically includes a range of solutions, from accounting and financial planning to risk management and compliance.

Key Components of a Modern CFO Tech Stack

1. Accounting and Financial Management

A robust accounting and financial management system is the foundation of a modern CFO tech stack. This includes solutions such as:

- General Ledger (GL) and Accounts Payable (AP) systems

- Financial planning and analysis (FP&A) tools

- Accounts Receivable (AR) and cash management systems

2. Financial Planning and Analysis (FP&A)

FP&A solutions enable CFOs to create detailed financial forecasts, analyze performance, and make data-driven decisions. Key features include:

- Budgeting and forecasting tools

- Financial modeling and simulation

- Performance metrics and dashboarding

3. Risk Management and Compliance

Effective risk management and compliance are critical to ensuring the integrity of financial operations. Solutions include:

- Enterprise risk management (ERM) systems

- Compliance management platforms

- Internal audit and control tools

4. Business Intelligence and Analytics

Business intelligence and analytics tools provide CFOs with real-time insights into financial performance, enabling data-driven decision-making. Key features include:

- Data visualization and dashboarding

- Predictive analytics and machine learning

- Big data management and integration

Benefits of a Modern CFO Tech Stack

A well-designed CFO tech stack offers numerous benefits, including:

- Improved Financial Management: Automate financial processes, reduce manual errors, and enhance financial reporting.

- Enhanced Decision-Making: Leverage real-time data and analytics to make informed decisions and drive business growth.

- Increased Efficiency: Streamline financial operations, reduce costs, and improve productivity.

- Better Risk Management: Identify and mitigate risks, ensure compliance, and maintain regulatory integrity.

Implementing a Modern CFO Tech Stack

Implementing a modern CFO tech stack requires careful planning, execution, and ongoing maintenance. Here are some best practices to consider:

- Assess Current Systems: Evaluate existing financial systems, identify gaps, and prioritize needs.

- Define Requirements: Determine the functional and technical requirements of each solution.

- Select the Right Vendors: Choose vendors that meet your requirements, offer scalability, and provide excellent support.

- Develop a Phased Implementation Plan: Roll out solutions in phases, ensuring minimal disruption to financial operations.

- Provide Ongoing Training and Support: Educate users on new systems, provide ongoing support, and continuously monitor performance.

Gallery of Modern CFO Tech Stack Solutions

FAQs

What is a CFO tech stack?

+A CFO tech stack refers to the collection of software applications, tools, and platforms used by the finance function to manage financial operations, analyze data, and make informed decisions.

What are the key components of a modern CFO tech stack?

+The key components of a modern CFO tech stack include accounting and financial management, financial planning and analysis, risk management and compliance, and business intelligence and analytics.

How do I implement a modern CFO tech stack?

+Implementing a modern CFO tech stack requires careful planning, execution, and ongoing maintenance. Assess current systems, define requirements, select the right vendors, develop a phased implementation plan, and provide ongoing training and support.

In conclusion, a modern CFO tech stack is essential for driving financial excellence, enhancing decision-making, and fostering growth in today's fast-paced business landscape. By understanding the key components, benefits, and implementation best practices, CFOs can build a tech stack that meets their organization's unique needs and propels them toward success.