Investing in the stock market can be a daunting task, especially for those seeking regular income from their investments. While dividend-paying stocks and bonds are popular options, they often come with limitations, such as low yields or high credit risk. However, there is an alternative strategy that can provide a relatively stable income stream while minimizing risk: covered call ETFs.

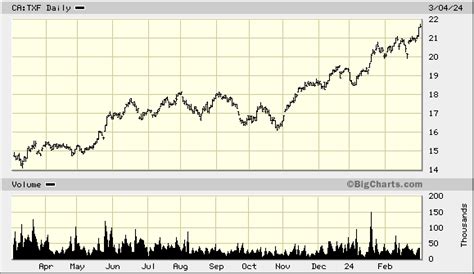

In this article, we will explore the Ci Tech Giants Covered Call ETF, a popular investment vehicle that employs a covered call strategy to generate income from a portfolio of technology giants.

What is a Covered Call Strategy?

A covered call strategy involves selling (or "writing") call options on underlying assets that the investor already owns. The buyer of the call option pays a premium to the seller, which is the income generated by the strategy. In exchange, the seller is obligated to sell the underlying asset at the strike price if the option is exercised.

The covered call strategy is often used to generate additional income from a portfolio of stocks, as it allows investors to monetize the volatility of the underlying assets. By selling call options, investors can earn a premium, which can help to increase the overall returns of their portfolio.

What is the Ci Tech Giants Covered Call ETF?

The Ci Tech Giants Covered Call ETF is an exchange-traded fund (ETF) that employs a covered call strategy to generate income from a portfolio of technology giants. The ETF is managed by CI Global Asset Management, a Canadian investment management firm with over $200 billion in assets under management.

The ETF invests in a portfolio of technology stocks, including giants such as Apple, Microsoft, and Alphabet (Google). The fund manager then sells call options on these underlying stocks to generate income. The premiums received from selling the call options are distributed to the ETF's investors, providing a regular income stream.

Benefits of the Ci Tech Giants Covered Call ETF

The Ci Tech Giants Covered Call ETF offers several benefits to investors, including:

- Regular Income Stream: The ETF provides a regular income stream, which can be attractive to investors seeking predictable returns.

- Lower Volatility: The covered call strategy can help to reduce the volatility of the ETF's returns, as the income generated from selling call options can offset potential losses from the underlying stocks.

- Diversification: The ETF invests in a portfolio of technology stocks, which can provide diversification benefits to investors seeking to reduce their exposure to individual stocks.

- Tax Efficiency: The ETF's income is distributed to investors as interest income, which can be more tax-efficient than dividend income.

How Does the Ci Tech Giants Covered Call ETF Work?

The Ci Tech Giants Covered Call ETF works as follows:

- Portfolio Construction: The fund manager constructs a portfolio of technology stocks, including giants such as Apple, Microsoft, and Alphabet (Google).

- Call Option Selling: The fund manager sells call options on the underlying stocks in the portfolio.

- Premium Collection: The fund manager collects the premiums from selling the call options.

- Income Distribution: The premiums are distributed to the ETF's investors as income.

- Portfolio Rebalancing: The fund manager rebalances the portfolio as needed to ensure that the ETF remains invested in a diversified portfolio of technology stocks.

Who is the Ci Tech Giants Covered Call ETF Suitable For?

The Ci Tech Giants Covered Call ETF is suitable for investors seeking a regular income stream from a diversified portfolio of technology stocks. The ETF may be particularly attractive to:

- Income Investors: Investors seeking predictable returns from their investments.

- Conservative Investors: Investors seeking to reduce their exposure to individual stocks or market volatility.

- Diversified Investors: Investors seeking to add a diversified portfolio of technology stocks to their investment mix.

Risks and Considerations

While the Ci Tech Giants Covered Call ETF can provide a regular income stream and lower volatility, there are risks and considerations to be aware of, including:

- Underlying Stock Risk: The ETF's returns are tied to the performance of the underlying technology stocks.

- Call Option Risk: The ETF's returns can be impacted by changes in the value of the call options sold.

- Interest Rate Risk: The ETF's returns can be impacted by changes in interest rates.

Conclusion

The Ci Tech Giants Covered Call ETF is a unique investment vehicle that employs a covered call strategy to generate income from a portfolio of technology giants. The ETF provides a regular income stream, lower volatility, and diversification benefits, making it an attractive option for investors seeking predictable returns. However, investors should be aware of the risks and considerations associated with the ETF and carefully evaluate their investment objectives and risk tolerance before investing.

Gallery of Technology Giants

FAQs

What is a covered call strategy?

+A covered call strategy involves selling (or "writing") call options on underlying assets that the investor already owns.

What is the Ci Tech Giants Covered Call ETF?

+The Ci Tech Giants Covered Call ETF is an exchange-traded fund (ETF) that employs a covered call strategy to generate income from a portfolio of technology giants.

Who is the Ci Tech Giants Covered Call ETF suitable for?

+The Ci Tech Giants Covered Call ETF is suitable for investors seeking a regular income stream from a diversified portfolio of technology stocks.