Crossroads Financial Tech is at the forefront of revolutionizing the finance industry, offering innovative solutions that are transforming the way financial institutions operate. With its cutting-edge technology and forward-thinking approach, Crossroads Financial Tech is poised to make a significant impact on the financial sector. In this article, we will explore five ways Crossroads Financial Tech is revolutionizing finance.

The Future of Finance: Embracing Innovation

The finance industry has traditionally been slow to adopt new technologies, but with the rise of fintech companies like Crossroads Financial Tech, this is changing. Crossroads Financial Tech is pushing the boundaries of what is possible in finance, using advanced technologies like artificial intelligence, blockchain, and the Internet of Things (IoT) to create new products and services.

1. Improving Financial Inclusion

One of the key areas where Crossroads Financial Tech is making a significant impact is in financial inclusion. Many people around the world lack access to basic financial services, such as bank accounts and credit. Crossroads Financial Tech is working to change this by developing innovative solutions that make it easier for people to access financial services.

For example, the company's mobile banking platform allows users to access their accounts and conduct transactions from their smartphones. This is particularly useful in developing countries where access to traditional banking services is limited.

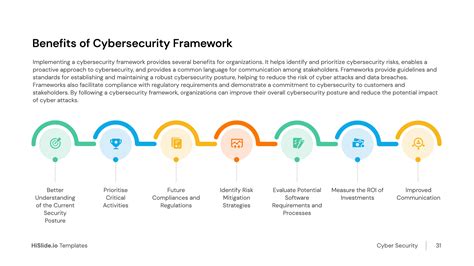

2. Enhancing Security

Security is a top priority in the finance industry, and Crossroads Financial Tech is at the forefront of developing innovative solutions to protect sensitive financial information. The company's use of blockchain technology, for example, provides a secure and transparent way to conduct transactions.

Crossroads Financial Tech is also developing advanced threat detection systems that use machine learning algorithms to identify and prevent cyber attacks. This ensures that financial institutions can protect their customers' sensitive information and prevent financial losses.

3. Streamlining Operations

Crossroads Financial Tech is also helping financial institutions to streamline their operations by automating manual processes and reducing costs. The company's use of robotic process automation (RPA) technology, for example, allows financial institutions to automate repetitive tasks such as data entry and document processing.

This not only reduces costs but also improves efficiency and accuracy, freeing up staff to focus on more complex tasks that require human expertise.

4. Providing Advanced Analytics

Crossroads Financial Tech is also providing financial institutions with advanced analytics capabilities that enable them to make better-informed decisions. The company's use of machine learning algorithms and data visualization tools, for example, allows financial institutions to gain insights into customer behavior and market trends.

This enables financial institutions to develop targeted marketing campaigns, improve customer engagement, and identify new business opportunities.

5. Enabling Open Banking

Finally, Crossroads Financial Tech is enabling open banking by providing financial institutions with the tools and technology they need to share customer data securely and efficiently. The company's use of application programming interfaces (APIs), for example, allows financial institutions to share customer data with third-party providers, such as fintech companies and retailers.

This enables customers to access a range of financial services from different providers, improving their overall financial experience.

Gallery of Financial Technology

Conclusion

Crossroads Financial Tech is revolutionizing the finance industry with its innovative solutions and forward-thinking approach. From improving financial inclusion to enabling open banking, the company is making a significant impact on the financial sector. As the finance industry continues to evolve, it's likely that Crossroads Financial Tech will remain at the forefront of innovation, shaping the future of finance for years to come.

If you have any questions or would like to learn more about Crossroads Financial Tech, please leave a comment below. We'd love to hear from you!

What is Crossroads Financial Tech?

+Crossroads Financial Tech is a fintech company that provides innovative solutions to financial institutions.

How is Crossroads Financial Tech improving financial inclusion?

+Crossroads Financial Tech is improving financial inclusion by developing innovative solutions that make it easier for people to access financial services.

What is open banking?

+Open banking is a financial services concept that allows customers to share their financial data with third-party providers, such as fintech companies and retailers.