The recent FS Tech Conference was a resounding success, bringing together some of the most innovative minds in the financial services industry. The conference was a hotbed of ideas, insights, and discussions on the latest trends and technologies shaping the future of finance. In this article, we'll delve into five key takeaways from the conference, exploring the most significant themes and innovations that emerged.

The Rise of Digital Banking

The FS Tech Conference highlighted the seismic shift taking place in the banking sector, as traditional institutions adapt to the digital age. One of the most striking insights from the conference was the importance of digital transformation in banking. As consumers increasingly expect seamless, omnichannel experiences, banks must invest in cutting-edge technologies to remain competitive.

Experts at the conference emphasized the need for banks to prioritize digital transformation, leveraging technologies like cloud computing, artificial intelligence, and blockchain to create more efficient, secure, and customer-centric services.

The Power of Artificial Intelligence

Artificial intelligence (AI) was a dominant theme at the FS Tech Conference, with many speakers highlighting its potential to revolutionize the financial services industry. From chatbots and virtual assistants to predictive analytics and risk management, AI is being used in a wide range of applications to drive innovation and efficiency.

One of the most interesting insights from the conference was the use of AI in risk management. By analyzing vast amounts of data, AI systems can identify potential risks and provide early warnings, enabling financial institutions to take proactive measures to mitigate them.

The Growing Importance of Cybersecurity

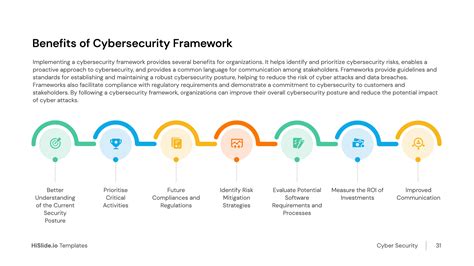

As the financial services industry becomes increasingly digital, cybersecurity is becoming a major concern. The FS Tech Conference highlighted the need for financial institutions to prioritize cybersecurity, investing in robust measures to protect themselves and their customers from the growing threat of cyberattacks.

Experts at the conference emphasized the importance of implementing robust cybersecurity measures, including encryption, firewalls, and intrusion detection systems. They also highlighted the need for financial institutions to educate their customers on cybersecurity best practices, empowering them to protect themselves from cyber threats.

The Potential of Blockchain

Blockchain technology was another major theme at the FS Tech Conference, with many speakers highlighting its potential to transform the financial services industry. From cross-border payments and securities settlement to identity verification and supply chain management, blockchain is being used in a wide range of applications to drive innovation and efficiency.

One of the most interesting insights from the conference was the use of blockchain in cross-border payments. By enabling fast, secure, and low-cost transactions, blockchain is poised to revolutionize the way we make international payments.

The Importance of Collaboration

Finally, the FS Tech Conference highlighted the importance of collaboration in driving innovation and growth in the financial services industry. From partnerships between banks and fintech startups to collaborations between financial institutions and technology providers, collaboration is key to unlocking the full potential of emerging technologies.

Experts at the conference emphasized the need for financial institutions to be open to collaboration, embracing new ideas and technologies to drive innovation and growth. By working together, we can create a more efficient, secure, and customer-centric financial services industry.

Gallery of Financial Technology

Frequently Asked Questions

What is the future of digital banking?

+The future of digital banking is expected to be shaped by emerging technologies like artificial intelligence, blockchain, and the Internet of Things (IoT). These technologies will enable banks to create more efficient, secure, and customer-centric services.

How can financial institutions improve their cybersecurity measures?

+Financial institutions can improve their cybersecurity measures by implementing robust security protocols, investing in employee training and awareness programs, and conducting regular security audits and risk assessments.

What are the benefits of blockchain technology in finance?

+The benefits of blockchain technology in finance include increased security, transparency, and efficiency. Blockchain enables fast, secure, and low-cost transactions, making it an attractive solution for cross-border payments and securities settlement.

We hope this article has provided valuable insights into the key themes and innovations emerging from the FS Tech Conference. As the financial services industry continues to evolve, it's essential to stay informed and adapt to the latest trends and technologies. We encourage you to share your thoughts and opinions on the future of finance in the comments below.