The world of private equity is complex and multifaceted, requiring a combination of financial acumen, business expertise, and technological prowess. In today's digital age, a robust tech stack is essential for private equity firms to stay competitive, streamline operations, and drive growth. In this article, we will delve into the essential components of a private equity tech stack, exploring the key tools, platforms, and technologies that underpin the industry.

What is a Private Equity Tech Stack?

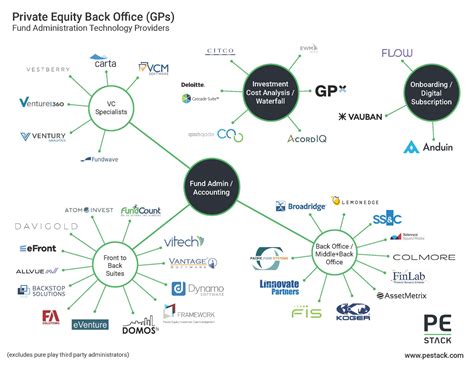

A private equity tech stack refers to the suite of software applications, tools, and platforms that a private equity firm uses to manage its operations, from deal sourcing and due diligence to portfolio management and exit strategies. The tech stack is the backbone of the firm's digital infrastructure, enabling teams to work efficiently, make informed decisions, and drive business growth.

Key Components of a Private Equity Tech Stack

- Deal Sourcing and Origination Platforms: These platforms enable private equity firms to identify and connect with potential investment opportunities. Examples include PitchBook, Merger Labs, and Origami.

- Customer Relationship Management (CRM) Systems: CRMs help firms manage relationships with investors, portfolio companies, and other stakeholders. Popular options include Salesforce, HubSpot, and Pardot.

- Data Analytics and Visualization Tools: These tools enable firms to analyze and visualize complex data sets, gaining insights into market trends, portfolio performance, and investment opportunities. Examples include Tableau, Power BI, and D3.js.

- Portfolio Management Software: These platforms help firms track and manage their portfolio companies, including financial performance, operational metrics, and ESG data. Examples include Dynamo, AltaReturn, and eFront.

- Cybersecurity and Data Protection Solutions: Private equity firms handle sensitive data, making robust cybersecurity measures essential. Solutions include firewalls, intrusion detection systems, and encryption technologies.

Benefits of a Well-Designed Private Equity Tech Stack

A well-designed tech stack can bring numerous benefits to a private equity firm, including:

- Improved Efficiency: Automation and workflow optimization enable teams to focus on high-value tasks, reducing manual errors and increasing productivity.

- Enhanced Decision-Making: Data analytics and visualization tools provide actionable insights, enabling firms to make informed investment decisions and drive business growth.

- Increased Transparency: Portfolio management software and CRM systems facilitate communication and collaboration between stakeholders, ensuring transparency and alignment.

- Better Risk Management: Cybersecurity and data protection solutions mitigate the risk of data breaches and cyber attacks, protecting sensitive information and reputations.

Implementing a Private Equity Tech Stack: Best Practices

Implementing a private equity tech stack requires careful planning, execution, and ongoing management. Best practices include:

- Define Clear Goals and Objectives: Align the tech stack with the firm's strategic objectives, ensuring that technology solutions support business outcomes.

- Conduct a Thorough Needs Assessment: Evaluate the firm's current technology infrastructure, identifying gaps and areas for improvement.

- Select Flexible and Scalable Solutions: Choose technology solutions that can adapt to changing business needs and growth.

- Develop a Comprehensive Integration Strategy: Ensure seamless integration between different technology platforms and systems.

- Provide Ongoing Training and Support: Equip teams with the skills and knowledge needed to effectively utilize the tech stack.

Conclusion

A private equity tech stack is a critical component of a firm's digital infrastructure, enabling teams to work efficiently, make informed decisions, and drive business growth. By understanding the key components, benefits, and best practices for implementing a private equity tech stack, firms can stay competitive, streamline operations, and achieve success in today's fast-paced investment landscape.

What is a private equity tech stack?

+A private equity tech stack refers to the suite of software applications, tools, and platforms that a private equity firm uses to manage its operations.

What are the key components of a private equity tech stack?

+The key components of a private equity tech stack include deal sourcing and origination platforms, CRM systems, data analytics and visualization tools, portfolio management software, and cybersecurity and data protection solutions.

What are the benefits of a well-designed private equity tech stack?

+A well-designed private equity tech stack can bring numerous benefits, including improved efficiency, enhanced decision-making, increased transparency, and better risk management.