The financial industry is evolving at a rapid pace, and credit unions are at the forefront of this change. As technology continues to play a larger role in the sector, the demand for skilled professionals with expertise in both finance and technology is on the rise. If you're interested in pursuing a career in tech at a credit union, here are five top career paths to consider:

1. Data Analyst

As a data analyst at a credit union, you'll be responsible for collecting, analyzing, and interpreting complex data to help inform business decisions. This role requires a strong understanding of statistics, data visualization, and data mining techniques. You'll work closely with various departments to identify trends, optimize operations, and drive growth.

Some key skills required for this role include:

- Strong analytical and problem-solving skills

- Proficiency in data visualization tools like Tableau or Power BI

- Experience with statistical programming languages like R or Python

- Excellent communication and presentation skills

Day-to-Day Responsibilities

- Develop and maintain databases to track key performance indicators (KPIs)

- Create data visualizations to present insights to stakeholders

- Analyze data to identify trends and areas for improvement

- Collaborate with departments to implement data-driven solutions

2. Cybersecurity Specialist

As a cybersecurity specialist at a credit union, you'll be responsible for protecting the organization's computer systems, networks, and data from cyber threats. This role requires a strong understanding of security protocols, threat analysis, and incident response.

Some key skills required for this role include:

- Strong knowledge of security frameworks and regulations (e.g., NIST, PCI-DSS)

- Experience with security information and event management (SIEM) systems

- Proficiency in programming languages like Python, C++, or Java

- Excellent problem-solving and analytical skills

Day-to-Day Responsibilities

- Monitor and analyze security logs to detect potential threats

- Develop and implement incident response plans

- Conduct vulnerability assessments and penetration testing

- Collaborate with IT teams to implement security patches and updates

3. Digital Banking Manager

As a digital banking manager at a credit union, you'll be responsible for overseeing the development and implementation of digital banking strategies. This role requires a strong understanding of online banking platforms, mobile banking apps, and digital payment systems.

Some key skills required for this role include:

- Strong knowledge of digital banking platforms and technologies

- Experience with project management methodologies (e.g., Agile, Waterfall)

- Proficiency in data analysis and reporting tools

- Excellent communication and leadership skills

Day-to-Day Responsibilities

- Develop and implement digital banking strategies to enhance member experience

- Collaborate with IT teams to develop and test digital banking platforms

- Analyze data to identify trends and areas for improvement

- Work with marketing teams to promote digital banking services

4. IT Project Manager

As an IT project manager at a credit union, you'll be responsible for overseeing the planning, execution, and delivery of IT projects. This role requires a strong understanding of project management methodologies, IT systems, and technical infrastructure.

Some key skills required for this role include:

- Strong knowledge of project management methodologies (e.g., Agile, Waterfall)

- Experience with IT service management frameworks (e.g., ITIL)

- Proficiency in project management tools like Asana, Trello, or MS Project

- Excellent communication and leadership skills

Day-to-Day Responsibilities

- Develop and manage project plans, timelines, and budgets

- Collaborate with IT teams to develop and test technical solutions

- Identify and mitigate project risks

- Communicate project status to stakeholders

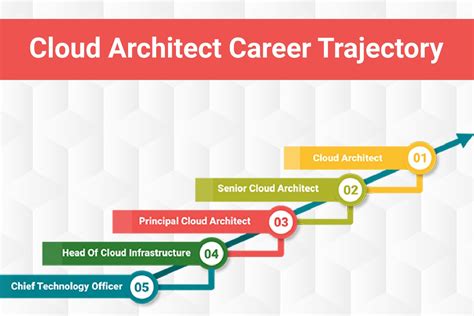

5. Cloud Architect

As a cloud architect at a credit union, you'll be responsible for designing and implementing cloud-based infrastructure and applications. This role requires a strong understanding of cloud computing platforms (e.g., AWS, Azure, Google Cloud), security protocols, and technical infrastructure.

Some key skills required for this role include:

- Strong knowledge of cloud computing platforms and technologies

- Experience with cloud security protocols and compliance frameworks

- Proficiency in programming languages like Java, Python, or C++

- Excellent problem-solving and analytical skills

Day-to-Day Responsibilities

- Design and implement cloud-based infrastructure and applications

- Collaborate with IT teams to develop and test cloud-based solutions

- Analyze data to identify trends and areas for improvement

- Work with stakeholders to develop cloud migration strategies

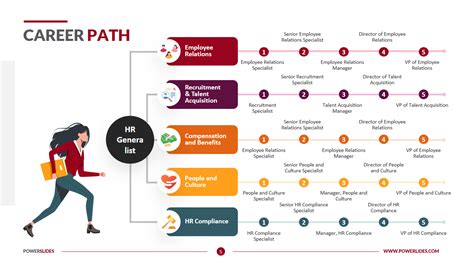

Gallery of Credit Union Careers

Frequently Asked Questions

What skills are required for a career in tech at a credit union?

+Skills required for a career in tech at a credit union vary depending on the role, but common skills include knowledge of IT systems, technical infrastructure, data analysis, and programming languages.

What are the benefits of working in tech at a credit union?

+Benefits of working in tech at a credit union include opportunities for career growth, competitive salaries, and a sense of purpose in serving members and the community.

How can I get started in a tech career at a credit union?

+To get started in a tech career at a credit union, research available roles and required skills, network with professionals in the industry, and consider pursuing relevant education or certifications.

We hope this article has provided you with valuable insights into the top tech career paths at credit unions. Whether you're just starting your career or looking to transition into a new role, there are many opportunities available in this exciting and rapidly evolving field. Remember to stay up-to-date with industry trends, develop your skills, and network with professionals to achieve success in your tech career at a credit union.