Are you in the market for a new car? With so many options available, it can be overwhelming to navigate the world of car loans. But, with a little research and planning, you can get the best tech cu car loan rates and drive away in your dream car. In this article, we'll explore the top 5 ways to get the best tech cu car loan rates and make your car-buying experience a breeze.

Understanding Tech CU Car Loans

Before we dive into the top 5 ways to get the best tech cu car loan rates, let's quickly understand what Tech CU car loans are. Tech CU, or Technology Credit Union, is a not-for-profit financial cooperative that offers car loans to its members. With competitive rates and flexible terms, Tech CU car loans are an attractive option for car buyers.

5 Ways To Get Best Tech CU Car Loan Rates

1. Check Your Credit Score

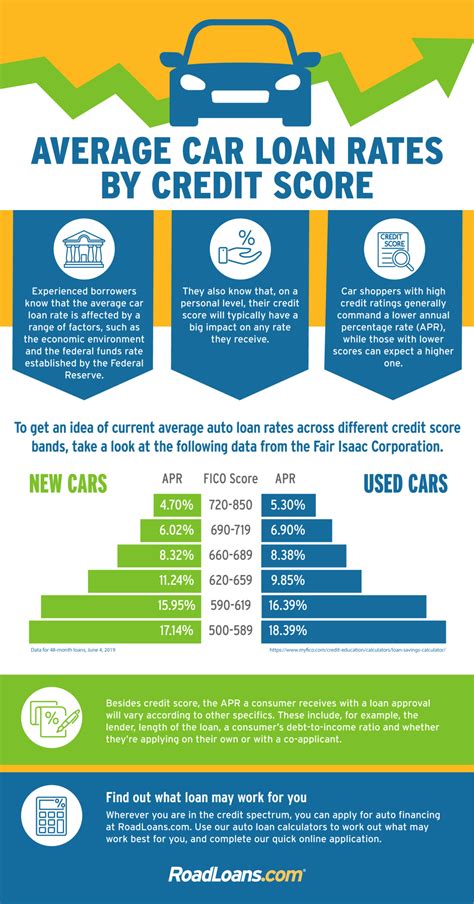

Your credit score plays a significant role in determining the interest rate you'll qualify for. A good credit score can help you qualify for lower interest rates, while a poor credit score can lead to higher rates. Before applying for a Tech CU car loan, check your credit score and work on improving it if necessary.

2. Research and Compare Rates

Don't settle for the first rate you're offered. Research and compare rates from different lenders, including Tech CU, to find the best deal. You can use online tools to compare rates and terms, and even negotiate with lenders to get a better rate.

3. Choose a Longer Loan Term

While it may seem counterintuitive, choosing a longer loan term can help you qualify for a lower interest rate. This is because lenders view longer loan terms as less risky, and are therefore willing to offer lower rates. However, be aware that longer loan terms can also mean paying more in interest over the life of the loan.

4. Make a Larger Down Payment

Making a larger down payment can help you qualify for a lower interest rate. This is because lenders view larger down payments as a sign of financial stability, and are therefore willing to offer lower rates. Additionally, a larger down payment can also reduce the amount you need to borrow, which can save you money in interest over the life of the loan.

5. Consider a Co-Signer

If you have a limited credit history or a poor credit score, consider having a co-signer with good credit. This can help you qualify for a lower interest rate, as lenders view co-signers with good credit as a sign of financial stability.

Gallery of Car Loan Tips

Frequently Asked Questions

What is the current interest rate for Tech CU car loans?

+The current interest rate for Tech CU car loans varies depending on the loan term and your credit score. Check the Tech CU website for the most up-to-date rates.

Can I apply for a Tech CU car loan online?

+Yes, you can apply for a Tech CU car loan online through the Tech CU website. Simply click on the "Apply Now" button and follow the prompts to complete your application.

What is the minimum credit score required for a Tech CU car loan?

+The minimum credit score required for a Tech CU car loan varies depending on the loan term and the type of vehicle you're purchasing. Check the Tech CU website for the most up-to-date information.

By following these 5 tips, you can get the best tech cu car loan rates and drive away in your dream car. Remember to always research and compare rates, and don't be afraid to negotiate with lenders to get the best deal. Happy car shopping!