The financial services industry has undergone significant transformations in recent years, driven by the increasing adoption of technology. One institution at the forefront of this revolution is Tech Cu Dublin, a cutting-edge technology and innovation center that is redefining the way financial services are delivered. In this article, we will delve into the world of Tech Cu Dublin and explore how it is harnessing the power of technology to revolutionize the financial services industry.

The Rise of Fintech

The financial technology (fintech) sector has experienced rapid growth in recent years, with the global fintech market projected to reach $124.3 billion by 2025. This growth is driven by the increasing demand for digital financial services, the need for greater efficiency and innovation in the financial sector, and the availability of advanced technologies such as artificial intelligence (AI), blockchain, and cloud computing. Fintech has disrupted traditional banking and financial services, enabling the creation of new business models, products, and services that are more customer-centric, efficient, and cost-effective.

The Role of Tech Cu Dublin

Tech Cu Dublin is a key player in the fintech ecosystem, providing a platform for innovation, collaboration, and growth. The center is dedicated to supporting the development of fintech companies, from start-ups to established players, by providing access to funding, mentorship, networking opportunities, and state-of-the-art facilities. By bringing together fintech companies, academics, researchers, and industry experts, Tech Cu Dublin fosters a culture of innovation and collaboration, driving the creation of new financial products and services that meet the evolving needs of consumers and businesses.

Harnessing the Power of Technology

Tech Cu Dublin is leveraging advanced technologies such as AI, blockchain, and cloud computing to revolutionize the financial services industry. For example, AI is being used to develop chatbots and virtual assistants that provide personalized customer support, while blockchain is being explored for its potential to increase the security and transparency of financial transactions. Cloud computing is also being used to provide scalable and flexible infrastructure for fintech companies, enabling them to quickly deploy new services and products.

Benefits of Technology in Financial Services

The adoption of technology in financial services has numerous benefits, including:

- Improved Efficiency: Technology automates manual processes, reducing the time and cost associated with financial transactions.

- Enhanced Customer Experience: Technology enables the creation of personalized and user-friendly financial products and services that meet the evolving needs of consumers and businesses.

- Increased Security: Technology such as blockchain and encryption provides a secure and transparent way to conduct financial transactions.

- Greater Accessibility: Technology enables the creation of financial products and services that are accessible to a wider range of people, including those in underserved communities.

Challenges and Opportunities

While technology has the potential to revolutionize the financial services industry, there are also challenges and opportunities that need to be addressed. These include:

- Regulatory Frameworks: The development of regulatory frameworks that support innovation and protect consumers is critical to the growth of the fintech sector.

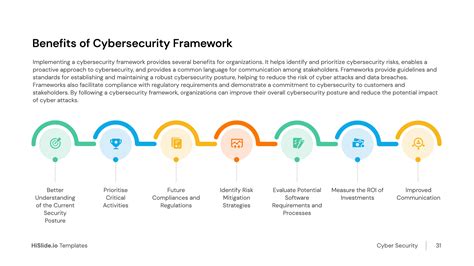

- Cybersecurity: The increasing use of technology in financial services has created new cybersecurity risks that need to be addressed.

- Talent and Skills: The fintech sector requires a workforce with the skills and expertise to develop and implement new technologies.

Conclusion

In conclusion, Tech Cu Dublin is at the forefront of the fintech revolution, harnessing the power of technology to transform the financial services industry. By providing a platform for innovation, collaboration, and growth, Tech Cu Dublin is driving the creation of new financial products and services that meet the evolving needs of consumers and businesses. As the fintech sector continues to grow and evolve, it is critical that regulatory frameworks, cybersecurity, and talent and skills are addressed to ensure that the benefits of technology are realized.

Gallery of Financial Technology

Frequently Asked Questions

What is fintech?

+Fintech is a term used to describe the intersection of finance and technology.

What is the role of Tech Cu Dublin in the fintech ecosystem?

+Tech Cu Dublin provides a platform for innovation, collaboration, and growth, supporting the development of fintech companies.

What are the benefits of technology in financial services?

+The benefits of technology in financial services include improved efficiency, enhanced customer experience, increased security, and greater accessibility.