Top 5 Technology Credit Union CD Rates

With the rise of online banking and digital financial services, technology credit unions have become increasingly popular. These credit unions offer competitive rates and terms on certificates of deposit (CDs), making them an attractive option for those looking to save money. In this article, we'll explore the top 5 technology credit union CD rates, their benefits, and what you need to know before investing.

Benefits of Technology Credit Union CDs

Technology credit union CDs offer several benefits, including:

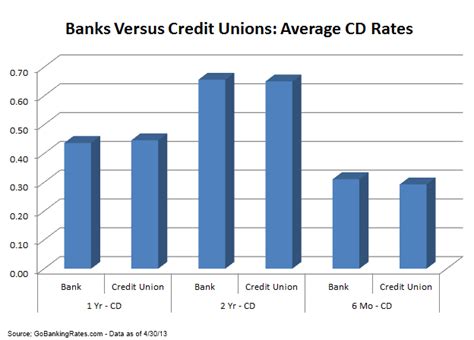

- Competitive interest rates: Technology credit unions often offer higher interest rates than traditional banks, helping you earn more on your savings.

- Low risk: CDs are insured by the National Credit Union Administration (NCUA), which means your deposits are protected up to $250,000.

- Flexibility: Technology credit unions offer a range of CD terms, from short-term to long-term, allowing you to choose the one that best fits your financial goals.

- Convenience: With online banking and mobile apps, you can easily manage your CD account and access your funds when needed.

Top 5 Technology Credit Union CD Rates

Here are the top 5 technology credit union CD rates:

- Alliant Credit Union: Alliant offers a range of CD terms, from 6 months to 5 years, with competitive interest rates. Their 5-year CD rate is 4.50% APY, with a minimum deposit of $1,000.

- Navy Federal Credit Union: Navy Federal offers CD terms from 3 months to 7 years, with rates ranging from 4.00% to 4.50% APY. Their 5-year CD rate is 4.40% APY, with a minimum deposit of $1,000.

- PenFed Credit Union: PenFed offers CD terms from 6 months to 7 years, with rates ranging from 3.50% to 4.50% APY. Their 5-year CD rate is 4.30% APY, with a minimum deposit of $1,000.

- Discover Credit Union: Discover offers CD terms from 3 months to 10 years, with rates ranging from 3.00% to 4.50% APY. Their 5-year CD rate is 4.20% APY, with a minimum deposit of $2,500.

- Capital One Credit Union: Capital One offers CD terms from 6 months to 5 years, with rates ranging from 3.00% to 4.30% APY. Their 5-year CD rate is 4.10% APY, with a minimum deposit of $1,000.

Things to Consider Before Investing

Before investing in a technology credit union CD, consider the following:

- Interest rates: Compare rates among different credit unions to ensure you're getting the best deal.

- Terms: Choose a term that aligns with your financial goals. Short-term CDs may offer lower rates, while long-term CDs may offer higher rates but require you to keep your money locked in for a longer period.

- Fees: Check for any fees associated with the CD, such as early withdrawal fees.

- Minimum deposits: Ensure you meet the minimum deposit requirements.

Final Thoughts

Technology credit union CDs offer competitive rates and terms, making them an attractive option for those looking to save money. By considering the benefits, rates, and terms, you can make an informed decision and find the best CD for your financial goals. Always remember to read the fine print and understand the fees and minimum deposit requirements before investing.

Engage with Us

We hope this article has provided you with valuable information on technology credit union CD rates. If you have any questions or comments, please feel free to share them below. We'd love to hear from you and help you make the most of your savings.

What is a CD?

+A CD, or certificate of deposit, is a type of savings account offered by banks and credit unions with a fixed interest rate and maturity date.

How do I open a CD?

+To open a CD, you'll need to visit the website of the credit union or bank offering the CD, or visit a branch in person. You'll need to provide personal and financial information, and fund the account with the minimum deposit required.

Can I withdraw my money from a CD before the maturity date?

+Yes, but you'll likely face early withdrawal penalties, which can reduce your earnings or even result in a loss of principal.